Becoming a homeowner in a foreign land is an exciting yet intricate journey. For non-U.S. citizens, securing a mortgage in the United States involves understanding and meeting specific requirements. We will explore the essential prerequisites and considerations for non-U.S. citizens aspiring to own a piece of the American dream.

Becoming a homeowner in a foreign land is an exciting yet intricate journey. For non-U.S. citizens, securing a mortgage in the United States involves understanding and meeting specific requirements. We will explore the essential prerequisites and considerations for non-U.S. citizens aspiring to own a piece of the American dream.

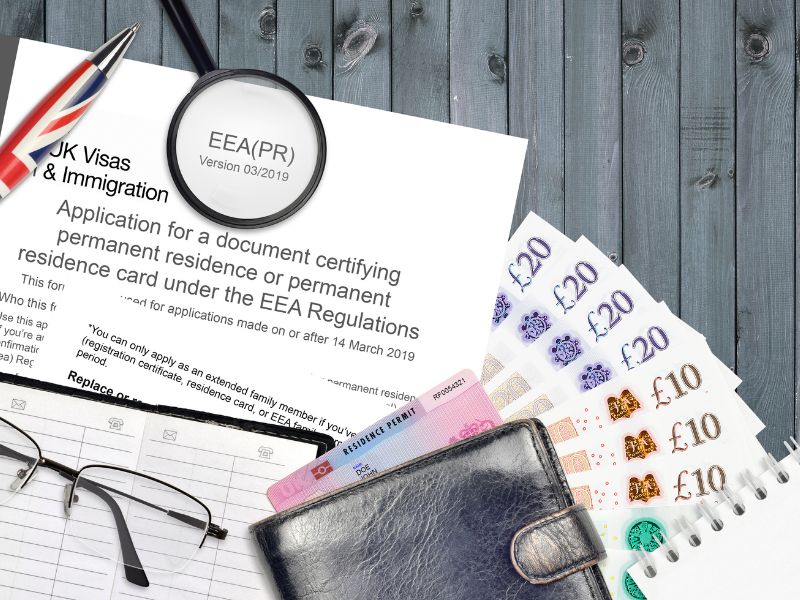

Visa Status and Residency: Before delving into the world of mortgages, non-U.S. citizens must first consider their visa status. Lenders often require borrowers to have a valid visa and proof of residency. Permanent residents (green card holders) may find it easier to qualify compared to those on temporary visas.

Credit History: A robust credit history is crucial when applying for a mortgage. Non-U.S. citizens should be prepared to provide documentation of their international credit history. This may include credit reports from their home country, showcasing a responsible financial track record.

Employment and Income Verification: Lenders want assurance that borrowers, regardless of citizenship, have a stable source of income. Non-U.S. citizens must be ready to provide proof of employment, income, and perhaps a history of employment in the U.S. for a specified duration.

Down Payment Requirements: The down payment is a significant factor in mortgage approval. Non-U.S. citizens might face higher down payment requirements compared to U.S. citizens. Typically, a down payment of 20% or more is common, although this can vary depending on factors such as creditworthiness and the lender’s policies.

Tax Identification Number (TIN) or Social Security Number (SSN): While non-U.S. citizens may not have a Social Security Number (SSN), they can obtain an Individual Tax Identification Number (ITIN) for tax purposes. Lenders may use this number to track your financial history and assess your creditworthiness.

Foreign Assets and Debts: Lenders may inquire about foreign assets and debts during the mortgage application process. Non-U.S. citizens should be transparent about any financial obligations abroad, as this information can influence the lender’s decision.

Legal Assistance: Given the complexity of mortgage applications for non-U.S. citizens, seeking legal advice is advisable. A real estate attorney specializing in international transactions can help navigate the legal intricacies, ensuring compliance with U.S. laws and regulations.

Currency Exchange Considerations: Non-U.S. citizens should be mindful of currency exchange rates, especially if their income and assets are in a different currency. Fluctuations in exchange rates can impact financial stability, so it’s essential to plan accordingly.

Lender Selection: Different lenders may have varying policies and requirements for non-U.S. citizens. It’s crucial to research and choose a lender experienced in working with international borrowers to enhance the likelihood of a smooth mortgage application process.

Securing a mortgage as a non-U.S. citizen involves careful preparation and attention to detail. By understanding and meeting the specific requirements outlined above, aspiring homeowners from around the world can confidently navigate the path to homeownership in the United States. With the right knowledge and assistance, the dream of owning a home in a foreign land can become a rewarding reality.